Today’s blustery global economy has everyone on edge as inflation has wreaked havoc on the wallets of ordinary people and energy prices continue to soar worldwide. According to Credit Suisse, “the worst is yet to come,” as the global investment bank’s analysts believe the European Union (EU) and the U.K. are already dealing with a recession. S&P Global has a similar hypothesis as a report published by the Manhattan corporation explains that the U.K. is currently contending with a full-year recession.

Nord Stream Pipeline Rupture Heightens Tensions Between Russia and the West — Putin Claims the ‘End of Western Hegemony Is Inevitable’

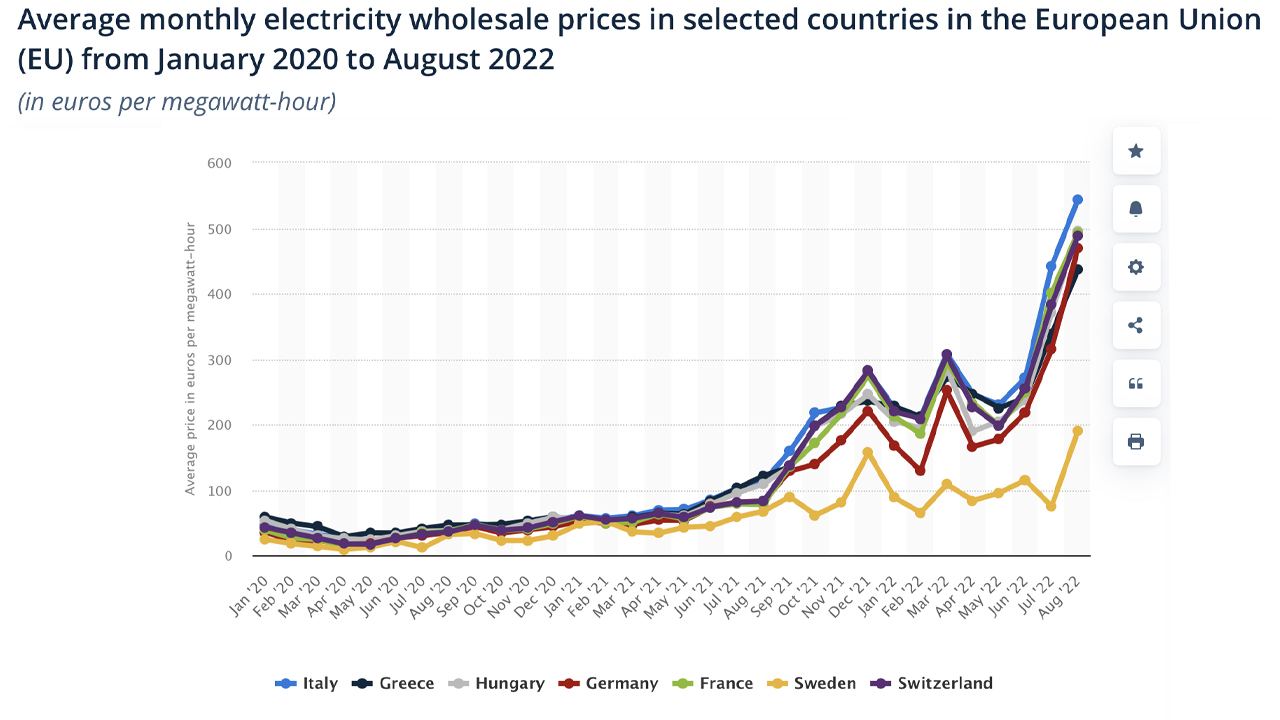

The world’s economy looks even worse following the Nord Stream pipeline rupture as many people believe the conflict between the West and Russia has heightened a great deal. The United Nations details that the destruction might have been the largest methane release ever recorded in history. Furthermore, the Nord Stream pipeline issue means Europe will have a tougher time accessing natural gas this winter. The price of natural gas in the EU has skyrocketed to a lifetime high alongside a myriad of European energy sources.

Moreover, both sides are blaming each other for the Nord Stream pipeline rupture as Vladimir Putin declared the act an “unprecedented sabotage” and an “act of international terrorism.” Meanwhile, U.S. president Joe Biden said the Nord Stream leak was a “deliberate act of sabotage” as well, and he further noted that the Kremlin blaming the U.S. for the rupture was simply untrue. Putin also noted during a recent speech that “the end of Western hegemony is inevitable.” The speech translated by Konstantin Kisin on September 30 explains that Putin thinks the West is greedy and seeks to enslave nations like Russia.

Kisin’s translation further says that Putin remarked that the West leverages finance and technology to bring other nations to submission. The West collects a “hegemon’s tax,” according to the Russian president. “They do not want us to be free, they want Russians to be a mob of soulless slaves,” Putin told the attendees at the event.

There was a strong reaction from the attendees and one individual says:

We’ll beat them all, we’ll kill them all, we’ll plunder all their stuff. It’s going to be what we love to do.

Credit Suisse and S&P Global Reports Note Europe and the UK Are Already Dealing With a Recession — ‘Europe Faces a Difficult and Uncertain Geopolitical and Economic Outlook’

Amid the heightened tension, a Credit Suisse report says the U.K. and Europe are already in a recession and the U.S. is “flirting” with one. The global investment bank’s analyst explained that some of the weight stemmed from central banks raising interest rates. “Higher rates combined with ongoing shocks lead us to cut GDP forecasts,” the Credit Suisse report details. “The euro area and the U.K. are in recession, China is in a growth recession, and the U.S. is flirting with recession.”

The Credit Suisse report adds:

Crucially, the rising share of price categories above central bank inflation target levels shows inflation is broadening out from a limited group of supply shock related drivers to more general inflation. This broadening requires tighter policy and weaker economies because it increasingly reflects tight labor markets.

The report from Credit Suisse follows the recent statements Citadel CEO Ken Griffin made last Wednesday at a conference. Griffin explained that Citadel is “very focused on the possibility of a recession.” Further, analysts in a report published by S&P Global explain that the U.K. and Europe are already in a recession and the Ukraine-Russia war is exacerbating the region’s gloomy economy. S&P Global’s regional credit conditions chairman, Paul Watters, says the EU has a tough winter ahead, and the European economy faces heightened credit risks.

Watters believes the EU’s measures to put price caps on energy will protect Europeans this winter from the inflationary pressures. “Fiscal support measures deployed by the government, notably the upper limit set on typical household energy bills, will significantly protect household budgets from an even greater inflation squeeze over the winter,” Watters claims. “This, along with ongoing resilience of the labor market, are the main reasons we do not expect the U.K. economy to perform worse.”

S&P Global’s report continues:

Europe faces a difficult and uncertain geopolitical and economic outlook as Russia’s political risk appetite appears to increase after losses of territory in Ukraine, and exorbitant energy prices fuel inflation, triggering interventions to support consumers and businesses, with central banks recalibrating interest levels in quick order.

Meanwhile, the U.S. Dollar Index (DXY) has dropped from the recent highs recorded nine days ago, and a myriad of fiat currencies worldwide have rebounded against the greenback. The euro has managed to rebound by 2.15% during the past seven days against the U.S. dollar, and the U.K.’s pound has increased 3.95% this week. However, the pound is down 14.98% during the last six months, and the euro has shed 11.25% against the greenback. Russia’s ruble, on the other hand, has increased 42.44% against the U.S. dollar during the last six months.

What do you think about the reports that say Europe and the U.K. are already in a recession? Let us know what you think about this subject in the comments section below.

source https://news.bitcoin.com/sp-global-report-says-eu-and-uk-are-in-a-recession-putin-thinks-the-west-is-greedy/

EmoticonEmoticon