The biggest crypto news and ideas of the day |

|

|

Good morning, and welcome to The Node. I'm Daniel Kuhn, here to take you through the latest in crypto news and why it matters. In today's newsletter: A bug was found in DeFi lender Compound's price feed, freezing its native ether token; bitcoin mining is poised to see the largest jump in difficulty since 2021. Read on for David Z. Morris' essay on coming crypto regulation. "First they laugh … then they fight you." If you were forwarded this newsletter and want to subscribe, sign up here. And click here to unsubscribe. – D.K. |

|

|

Market for Compound Ether Token Is 'Frozen' After Code Bug Kills Price Feed: Decentralized finance (DeFi) lending protocol Compound (COMP) has suffered a critical failure, effectively halting the trade of Compound ether (cETH), after a bug was discovered in the code that causes transactions for suppliers and borrowers to fail. - A fix is coming in the next code proposal, but it will take seven days to go into effect.

- Compound's COMP protocol token seems largely unaffected by the news, trading down just 1.8% during the last 24 hours amid a wider market pull back.

Crypto Exchange FTX's CEO Visited White House Amid Regulatory Fight: FTX CEO Sam Bankman-Fried and his regulatory team met with White House policy adviser Charlotte Butash in May as lawmakers in the United States debate whether to have the Commodity Futures Trading Commission (CFTC) or the Securities and Exchange Commission (SEC) act as the crypto industry's primary federal market regulator. - FTX currently has a proposal before the CFTC to allow it to settle certain crypto-related transactions directly, which has been staunchly opposed by the traditional finance (TradFi) industry.

- Bills are currently working their way through the House of Representatives and the Senate that would give the CFTC more crypto market oversight, but progress is slow.

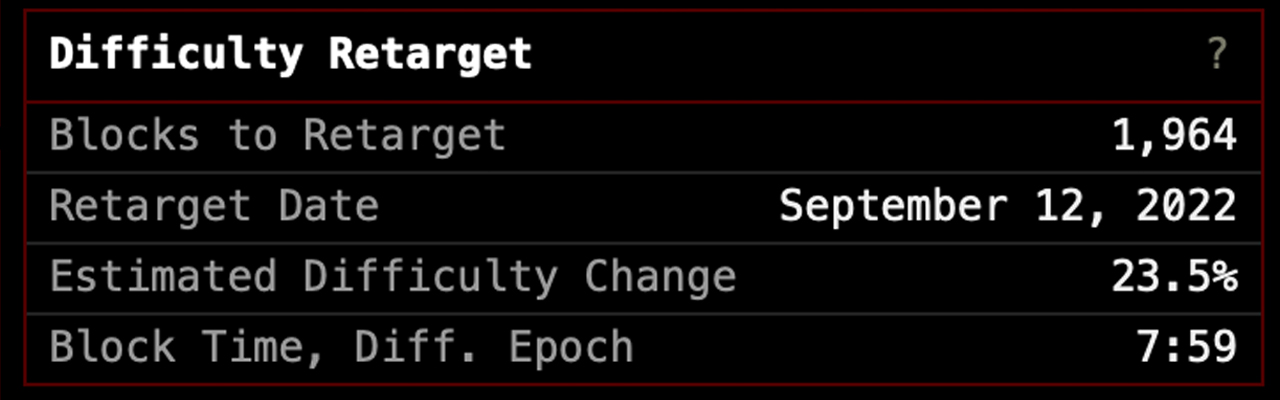

Bitcoin Mining Difficulty Spiked Ahead of Colder Weather: Bitcoin mining difficulty rose by 9.3% on Wednesday, hitting the second highest level ever recorded. This matched industry expectations as North America begins ramping up production ahead of the cooler months, increasing competition between Bitcoin block producers. - Analysts speaking to CoinDesk said the uptick is a likely result of more and newer machines coming online, as well as the waning impact of heatwaves. (The difficulty programmatically resets about every two weeks, based on how much hash power miners contribute to the network.)

- Today's spike is also one of the largest jumps since August 2021, when miners began to come back online after the industry was banned in China, which at the time was home to 44% of mining activity.

BNB Chain Introduces Liquid Staking to Provide Crypto Users Access to More Income Streams: The base blockchain of crypto exchange Binance has introduced so-called liquid staking with three leading Web3 protocols: Ankr, Stader and pStake. Users who have staked, or locked, their tokens for some use are issued new tokens with an equivalent value. - The new tokens represent ownership of the underlying ones, are fully transferable and can be unwrapped to reclaim the staked assets. Meanwhile, they can be used to generate yield, thus freeing up capital and making such products attractive to users.

- Liquid staking becomes more popular as Ethereum proceeds toward becoming a proof-of-stake (PoS) system. Coinbase (COIN) said last week it plans to offer its own liquid staking token, called Coinbase wrapped staked ETH (cbETH).

– Xinyi Luo |

The Right Place for Your Crypto Nexo marks the spot. As in the right spot for you to grow your crypto wealth and keep it secure. Buy BTC, ETH, and more with your debit or credit card or swap between 300+ market pairs and get 0.5% in crypto rewards on each transaction. If you're looking to enhance your spending power, Nexo is the right place. Borrow without selling your crypto at rates starting from 0% and grow your portfolio. The right place brings you and your friends together and gives you both crypto rewards. Get $25 in BTC for every successful referral. Collect rewards as you go and enter the race for a $50 000 prize pool which will be distributed between the top 50 contestants. Enter the competition until July 26, 2022. Timing the market can be a tall order. Choosing the right place is not.

Grow your crypto on the highly-rated Nexo platform. |

|

|

Putting the news into perspective |

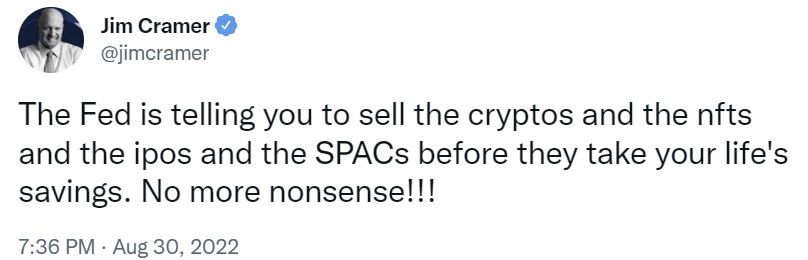

Then They Fight You: Scenarios for Coming Crypto Regulation I can't count how many times over the years I've seen someone on Crypto Twitter trot out the old saw that starts with "First they ignore you, then they laugh at you …" Well, be careful what you wish for, because over the past year, we've clearly reached the "then they fight you" portion of the quote often misattributed to Mahatma Gandi. For more than a decade, regulators including the U.S. Securities and Exchange Commission have been imposing only minimal restraints and targeting egregious frauds for prosecution, but otherwise leaving crypto largely to its own devices. But when Gary Gensler was appointed to head the SEC under the Biden administration, he signaled early and often his intention to take a more rigorous approach. That attitude has manifested in a variety of ways, even beyond Gensler's formal domain. In May, the SEC doubled the number of staffers in its enforcement division who were focused on crypto. Sanctions against the Tornado Cash privacy software by the Office of Foreign Assets Control have triggered the most acute worry in the industry, and will face legal challenges. And last week saw filings from Grayscale Investments acknowledging, in response to an SEC inquiry, that the stellar, zcash and horizen crypto tokens "may currently be" securities. (Grayscale and CoinDesk are both owned by Digital Currency Group.) Some of this increased scrutiny may be simply a consequence of crypto's growing influence and stakes, rather than entirely due to Gensler. According to law blog Legal Intelligencer, cryptocurrency enforcement actions by the SEC have shot up to 79 for the three years from 2018 to 2021 from just 18 between 2013 and 2017. But it also does no good to deny the obvious: Gensler came in ready to regulate, and he got a convenient mandate courtesy of the immense amount of truly damaging fraud and foolhardy experimentation in crypto. That was always present, but the increased exposure of the general public to crypto speculation during the 2020-2022 bull market made the situation far more dangerous than it had been. Possible outcomes There are two, maybe three, possible outcomes here. The most likely, unfortunately, is that Gensler's SEC places mounting legal pressure on both token issuers and exchanges, primarily using even more enforcement actions to treat tokens as securities in a relatively uniform way. That would almost certainly strangle many good crypto projects along with the bad. The preferable alternative would be a real attempt to structure rules that wouldn't hamper the potential of this new technology, along the lines of the formal time-limited safe harbor proposed by SEC Commissioner Hester Peirce. |

|

|

(Chip Somodevilla/Getty Images) That proposal included data-reporting requirements for token projects (good) but didn't place any prior restraints on entities that wanted to try something new (also good). Personally, I would love to see additional safe-harbor permissions for tokens with very low value, the sort that might be deployed for small-scale DAOs (decentralized autonomous organizations) or other truly community-driven projects. But let's be realistic: Regulation that leaves substantial room for experimentation isn't particularly likely to come to fruition. In part, that's because Congress remains a bit of an ineffectual mess, ill-equipped to craft complex and rational new rules. But more fundamentally, the SEC and other regulators just aren't set up to grapple with the truly mind-bending complexities of blockchain's crossover between technology and finance. That disconnect may be inevitable, because regulation implies a normative vision of the way things "should" be. Embracing risk and chaos and figuring it out as we go is probably the only real way to find out the long-term potential of these innovations. Growth and hucksterism But that possibility has basically closed over the past two years, thanks to a combination of real growth and shameless hucksterism. Figures like Alex Mashinsky and Do Kwon conveniently disregarded the experimental nature of the products they were promoting to the general public, and real engineers and designers tinkering at the truly bleeding edge are poised to pay a completely undeserved penalty. As these tighter constraints close in, it will be increasingly important to remember what's actually being targeted by stricter regulation. Ultimately, the problem is not cryptocurrency or blockchain itself, which are merely technologies. The problem is that they have been overhyped and exploited to further a much larger system in which promotion of high-risk investments yield big rewards, even if those investments are more likely to get vaporized. The same dynamic is in play in the "regulated" venture capital industry. We recently saw the absurdity of another $350 million being handed to low-rent P.T. Barnum Adam Neumann, who became a billionaire in the course of destroying $11 billion of other people's money at WeWork. Is Neumann a smarter, better or more trustworthy person than Do Kwon? That seems like a stretch. Of course, there is a potential upside as the crackdown ramps up: it could return cryptocurrency to its roots. The fat days of loose oversight removed incentives to build truly robust systems that could operate beyond government reach, in favor of fragile systems with superficial features that could be shilled to retail. Features like censorship resistance and true decentralization are about to get a lot more important, and in the long run, that could be the best outcome of all. – David Z. Morris |

|

|

Join 2,000+ attendees from the NEAR and Web3 ecosystem along with hundreds of hackers in the stunning coastal city of Lisbon for NEARCON, "Building Beyond the Hype," September 11-14. Part conference, part festival, and part IRL hackathon, for 3.5 days NEARCON will bring together authors, economists, artists, politicians, builders, multi-chain collaborators, and makers across many industries. NEARCON will be a welcoming, collaborative atmosphere for all. Promocode COINDESK for 35% off tickets! |

|

|

Overheard on CoinDesk TV... |

"We've been leaning heavier into that tech stack." – Mythical Games CEO John Linden, discussing the company's new Ethereum compatible chain, on CoinDesk TV's "First Mover" |

|

| Kevin Rose's Proof: From NFT Drop to Growing Web3 Biz, With a CC0 Twist (Decrypt) Christensen Calls For MakerDAO to Float Stablecoin (The Defiant) FedNow is coming next year and the feds hope it's a crypto killer (Protos) Cryptocurrency firm accidentally sent $10.5 million rather than $100 to Australian woman but took 7 months to realize (Business Insider)

|

|

|

Which institutes are most impacting the blockchain world? Tell us your thoughts in a five-minute survey. We're welcoming responses until Sept. 7. Take the survey here. |

|

|

Shop2Earn: The Benefits of The SocialGood App Token-gated platforms have become an increasingly popular trend in the crypto sector. Though many are still in early development, the SocialGood App has long stood out as a leader in the market. With more than 68 patents and a growing user base of more than 2 million, SocialGood App is well on its way to achieving its mission of building the world's largest global platform. The gamified, shop-to-earn app made headlines in March following a $14.2 million Series A funding round that was backed by prominent investors led by Miyako Capital. The app had experienced growth of five times in the three months before the funding round, with significant adoption from users in the U.S. Continue reading here *This is sponsored content from SocialGood. |

|

|

|