|

|

Rich Dad Poor Dad author Robert Kiyosaki says the Fed is wiping out regional banks by supporting only big banks, like JPMorgan Chase. Stating that the Fed “is criminal,” he warned that its actions “will bring down” the United States.

The author of Rich Dad Poor Dad, Robert Kiyosaki, warned in a series of tweets this week that the Fed is wiping out regional banks by supporting only the big banks, such as JPMorgan Chase. Rich Dad Poor Dad is a 1997 book co-authored by Kiyosaki and Sharon Lechter. It has been on the New York Times Best Seller List for over six years. More than 32 million copies of the book have been sold in over 51 languages across more than 109 countries.

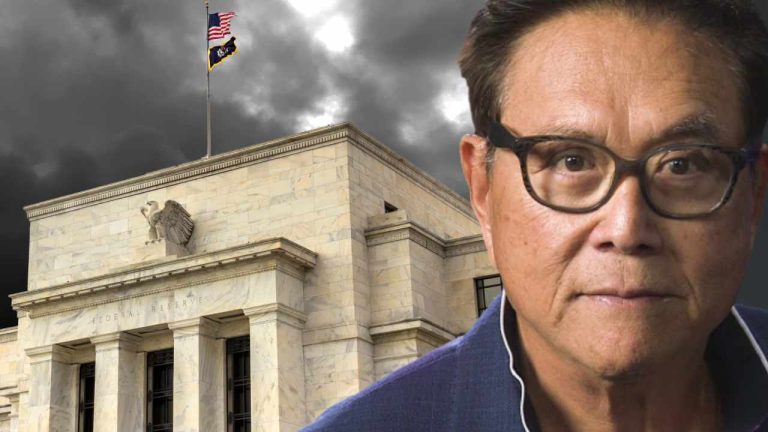

Kiyosaki tweeted Wednesday: “WTF. What The Fed? Why is Fed destroying regional banks across America? Regional banks are [the] heart and soul of [the] economy. Fed via the Repo Market [is] killing regional banks. Is this intentional? Is a depression intentional? WTF is Fed up to? Get $ out of regionals.”

The renowned author followed up with a tweet Thursday, stating that even online retail giant Amazon is affected by the Fed’s actions. “Without credit flowing, Amazon is cutting 18,000 jobs,” he stressed, adding:

The ripple effect from WTFed will bring down USA … WTFed wiping out regional banks.

In a separate tweet, Kiyosaki cautioned that by supporting only the big banks, such as JPMorgan Chase, the Fed is wiping out regional banks. Calling the Fed’s action “Cruel,” Kiyosaki reiterated his previous statement that regional banks are the heart and soul of America. Calling the Fed “criminal,” he then urged his 2.4 million Twitter followers to support small banks and small businesses.

On Friday, Kiyosaki warned in another tweet about President Joe Biden’s central bank digital currency (CBDC) and went on to recommend his customary choices of investing in additional gold, silver, and bitcoin. He wrote:

In his book 1984, George Orwell warned ‘Big Brother is watching.’ Biden’s CBDC is ‘Big Brother.’ Buy more gold, silver, and bitcoin.

In a recent episode of his Rich Dad Show, Kiyosaki discussed economic chaos, war breaking out, and rising starvation. Earlier this month, he said, “America is dying,” warning about hyperinflation and the death of the U.S. dollar.

Do you think the Fed is criminal like Rich Dad Poor Dad author Robert Kiyosaki said? Do you think regional banks are being wiped out? Let us know in the comments section below.

The chairman of the State Duma Committee on the Financial Market says that an agreement on the BRICS currency can be reached in 2023 as BRICS nations ramp up their de-dollarization efforts to shift away from U.S. dollar reliance. “By linking its economy and currency to politics, the U.S. is practically undermining the foundations of its dominance,” said the Russian official.

Anatoly Aksakov, Chairman of the State Duma Committee on the Financial Market, discussed BRICS currency and the de-dollarization trend on Wednesday at the press center of Parliamentary Newspaper, the publication of the Federal Assembly of the Russian Federation.

Aksakov expects the share of the U.S. dollar in international trade to decline, noting that Americans continuing to destroy the value of the dollar with their own hands shows the whole world that the USD is being used for political purposes. He said:

By linking its economy and currency to politics, the U.S. is practically undermining the foundations of its dominance. I am sure that the share of the dollar in world trade will steadily decline.

The Russian official added that now there is a search for some kind of collective currencies, emphasizing that a discussion on this topic is already on the agenda of the BRICS countries (Brazil, Russia, India, China, and South Africa).

Aksakov further stated that while the negotiations are at an early stage, an agreement can be reached in 2023.

The BRICS nations have been ramping up their de-dollarization efforts and are currently working to create a common currency that will reduce their reliance on the U.S. dollar. State Duma Deputy Chairman Alexander Babakov said last month that BRICS currency is expected to be discussed at the next leaders’ summit in August.

The economic bloc is also pushing to expand its global influence. A Russian official said this week that Russia is actively discussing BRICS expansion with member countries. So far, 19 nations have either applied to join the group or have expressed interest to join. However, multiple people have warned that a BRICS currency will erode the U.S. dollar’s dominance.

Do you think the BRICS currency will undermine the U.S. dollar’s dominance? Let us know in the comments section below.

Pepe (PEPE), the meme coin featuring the popular character Pepe the Frog, has experienced a significant surge in value in the past week, rising by 152.9% against the U.S. dollar. Recent statistics indicate that PEPE’s market capitalization has surged from $141 million on April 22 to a current valuation of $303 million.

On April 30, 2023, the top meme coin crypto assets by market capitalization are worth $19.11 billion. Over the past 24 hours, the valuation of all meme tokens has risen 1.6%. However, only two out of the top five meme coins by market capitalization have seen gains. The newly launched cryptocurrency, pepe (PEPE), is leading the pack with triple-digit gains. Data collected from coingecko.com shows that over the last seven days, PEPE has risen 152.9%, with most of the gains coming from the last 24 hours as the token jumped 99% higher on Sunday.

Bitcoin.com News reported on PEPE and several other meme coin assets eight days ago. At that time, PEPE was the sixth-largest meme token asset by overall valuation. Today, PEPE is the fifth-largest, and the market capitalization recorded on April 22 of $141 million has risen to more than $303 million. On April 30, PEPE had $149.63 million in global trade volume, hovering just below cardano’s (ADA) daily volume on Sunday. The meme token is down 10% lower than its all-time high recorded on Sunday at $0.000000813847 per unit.

PEPE is also 1,217% higher than the all-time low of $0.000000055142 per unit recorded on April 18, 2023, or roughly two weeks ago. There are 420.69 trillion PEPE coins in circulation today. According to coincarp.com statistics, there are 55,024 PEPE holders today. The top ten wallets hold 20.64% of the entire supply, and the top 100 PEPE holders control 43.82% of the current supply. While PEPE is hosted on centralized exchanges, the coin’s trading activity is mostly on the decentralized exchange (dex) Uniswap (v2).

The market value of the meme coin economy has undergone significant fluctuations in recent months, with dogecoin (DOGE) and shiba inu (SHIB) experiencing ups and downs. Meme coin assets have garnered increasing demand from investors and speculation in the cryptocurrency market since their significant rise in value since 2020. The meme coin economy is well-known for its volatility, but DOGE and SHIB have remained at the forefront of the meme coin market for the last two years. While the market value of these meme coins may fluctuate, their impact on the broader crypto economy has not been ignored.

What do you think about the recent surge of PEPE the meme coin and its impact on the overall meme coin market this week? Share your thoughts and predictions in the comments section below.

Sales of non-fungible tokens (NFTs) have declined by 5.76% over the past 30 days, according to the latest NFT sales statistics. The data reveals that the sales figure stood at $732.13 million in April, which is $44.75 million lower than the $776.88 million recorded in March.

NFT sales surpassed $1 billion in both January and February 2023; however, sales figures declined in March and April. According to cryptoslam.io’s latest NFT sales data for April, the sales stood at $732.13 million, which is 5.76% lower than the previous month.

Out of this amount, Ethereum-based NFT sales dominated the market, accounting for $485 million in trades. However, Ethereum NFT sales declined by 19% in April compared to March figures.

Meanwhile, Solana-based NFT sales recorded $88.16 million, down 6.78% from last month. The top five blockchains with the most NFT sales in April, following Ethereum and Solana, were Polygon, Immutable X, and BNB Chain, as per the latest data.

During the month of April, Polygon witnessed a surge in sales by 22.75%. Meanwhile, Arbitrum, the sixth-largest blockchain in terms of NFT sales, saw sales spike by 78.35%, amounting to $10.29 million. In terms of NFT collections, Bored Ape Yacht Club (BAYC) emerged as the leader with $45.10 million in sales.

Azuki NFTs secured the second spot with $21.91 million in sales over the past month. Nakamigos, Mutant Ape Yacht Club, and Mad Lads followed BAYC and Azuki in terms of NFT sales. Sandbox’s Land #21,221 emerged as the top-selling NFT in the past month, with a sale price of $1.256 million, approximately 20 days ago.

The second most expensive NFT sale in April was Maverick Position #386, which fetched $1.05 million, 16 days ago. Azuki #3,628 secured the third spot on the list, selling for $626K, 18 days ago, followed by Azuki #5172, which was acquired for $458K. The fifth most expensive NFT sale in April was CryptoPunk #3,990, which sold for $444K, 24 days ago.

As of Sunday, April 30, 2023, nftpricefloor.com reports that the collection with the highest floor value is Cryptopunks, currently standing at around 49.99 ether. Just below Cryptopunks is Bored Ape Yacht Club (BAYC), with a floor of around 48.69 ether. The floor values of the top collections following Cryptopunks and BAYC include Mutant Ape Yacht Club, Azuki, and Otherdeed.

What do you think the future holds for the NFT market, and how do you think the decline in sales figures in March and April will impact the industry going forward? Share your thoughts about this subject in the comments section below.

| What's the right credit score to buy a house in Canada?

|

After the most recent increase in the federal funds rate, the U.S. Federal Reserve is set to raise the lending rate by 25 basis points (bps) to 5.25% in three days, according to expectations. A recent poll of 105 economists revealed that 94 of them predict a 25bps rate hike will occur during the May 2-3 Federal Open Market Committee (FOMC) meeting. While economists are anticipating a rate hike in May, they anticipate that it will be the final one in 2023. The majority of polled economists believe that the Fed will maintain the rate at 5.25% for the remainder of the year.

Several reports and surveys indicate that market observers believe the U.S. central bank will increase the benchmark interest rate by 25bps at the FOMC meeting this week. The FOMC meeting is scheduled to take place on May 2-3 and according to the CME Group Fedwatch tool, 83.9% suspect a 25bps rate hike will come to fruition. On the other hand, the Fedwatch tool shows 16.1% predicts no rate hike for the upcoming May meeting.

The most recent predictions ahead of the next FOMC meeting are similar to the forecasts economists gave at the beginning of April 2023. Additionally, Bloomberg reported on April 29, that economists the publication talked to also believe a 25bps rise is in the cards.

Bloomberg’s economics report states:

Signs point to the FOMC raising rates by 25 basis points to 5.25% in the May 3 decision — despite ongoing turmoil in the banking system — and signaling that this will be the last hike for a while. The next phase of the tightening cycle will be to hold rates at that elevated level, while watching to see if inflation trends down.

According to a survey from Reuters, a vast majority (90%) of 105 economists polled suspect a 25bps hike. Additionally, 59 of those economists believe that the federal funds rate will remain unchanged for the rest of the year following the predicted May hike, while 26 participants are forecasting a rate cut. Furthermore, most of the economists surveyed by Reuters do not anticipate the inflation rate in the U.S. to reach the Fed’s 2% target until 2025. The economists also noted that there’s still a risk of inflation rates spiking again this year.

Michael Gapen, the chief U.S. economist at Bank of America (BOFA) Securities, commented that a whole lot remains to be accomplished before the 2% goal can come to a realization. Gapen also added that it is uncertain whether or not the Fed will hike the benchmark rate after May.

“On the data front, despite the slowdown in inflation in March, there is still a lot more work to be done to get back to the 2% target,” Gapen said. “We maintain the first rate cut in March 2024. Should the stresses in the financial system be reduced in short order, we cannot rule out that stronger macro data will lead the Fed to put in additional hikes beyond May,” the BOFA executive added.

What do you think the impact of the expected rate hike by the U.S. Federal Reserve will have on the economy? Share your thoughts in the comments section below.