The latest moves in crypto markets, in context March 1, 2022 Supported by Was this newsletter forwarded to you? Sign up here.

Good morning, and welcome to First Mover. Here's what's happening this morning:

And check out the CoinDesk TV show "First Mover," hosted by Christine Lee, Emily Parker and Lawrence Lewitinn at 9:00 a.m. U.S. Eastern time. Today's show will feature guests:

Today's newsletter was edited by Omkar Godbole and produced by Parikshit Mishra.

Market Moves By Omkar Godbole Bitcoin neared the $45,000 mark, extending Monday's gain despite risk aversion in traditional markets.

The futures tied to the S&P 500 slipped, the 10-year Treasury yield hit one-month lows and the yield on the 10-year German bund yield returned to negative territory after a month.

In currency markets, the safe-haven U.S. dollar and Japanese yen picked up a bid, while the growth-sensitive Aussie and Kiwi dollars erased early gains. Gold rose 0.5% and oil jumped 5% on both sides of the Atlantic.

The traditional market action signaled lingering anxiety and a sense of apprehension, given the Russia-Ukraine peace talks failed to achieve anything concrete yesterday and violence continued.

"We may see another round in the days ahead. In the meantime, don't expect the hostilities in Kyiv to ease as the push and pull on the ground and sanctions continue," ForexLive's Justin Low said in a market update.

Ready to explore the Metaverse?

Analysts predict the Metaverse could be a trillion-dollar revenue opportunity across advertising, social commerce, digital events, and hardware, as well as developer and creator monetization.1

This creates a unique investment opportunity in the new digital economy.

Grayscale gives investors a way to access the early opportunity of the Metaverse through Grayscale® Decentraland Trust, a security solely invested in and deriving value from Decentraland's native token MANA. Decentraland is one of the leading Metaverses built on the Ethereum blockchain.

Invest in the Metaverse with Grayscale2. Learn more here.

2 Private placement available to accredited investors only

Carefully consider each Product's investment objectives, risk factors, fees and expenses before investing. Products are distributed by Genesis Global Trading, Inc. (Member FINRA/SIPC, MSRB Registered).

Crypto Prices Bitcoin (BTC) See the latest price here Ether (ETH) See the latest price here The following are the biggest movers in the CoinDesk 20 digital assets over the past 24 hours: Biggest Gainers: Biggest Losers: There are no losers in CoinDesk 20 today. Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive, and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.

It's never been easier to earn interest on Bitcoin and Tether with BitMEX EARN. Enjoy up to 10% APR on Tether and 4% on Bitcoin, fully backed by the BitMEX Insurance Fund.

With new products, reliable security, and responsive customer service, there's never been a better time to join BitMEX. Start earning interest today by subscribing to EARN here.

BitMEX products and services are not available to US Persons and in other specified jurisdictions.

Latest Headlines

Bitcoin Sees Increased Demand from Ukraine and Russia By Omkar Godbole

Bitcoin ended February with a 12% gain, snapping the three-month losing streak, which saw the cryptocurrency tank from $69,000 to $39,000.

Almost the entire monthly gain stemmed from Monday's 14.5% surge, the most significant daily percentage rise since Feb. 8, 2021. Analysts cited a short squeeze and pick up in demand from Ukraine and Russia as catalysts fueling the move higher.

"In percentage terms, bitcoin recorded the largest daily candle in more than a year, gaining more than 18% day-over-day at the highest point of the rally," Mikkel Morch, executive director at crypto hedge fund ARK36 said in an email. "While it seems that the second leg of the move was at least partially fuelled by a small short-squeeze, overall, the rally was driven by a huge spike in demand."

Trader and analyst Alex Kruger tweeted, "Word on the street has been heavy bitcoin buying conducted by both Ukrainians and Russians. Mostly the latter. They have more money to protect."

"Bitcoin traded at a significant premium in ruble terms on Monday," Kuger told CoinDesk in a Telegram chat, adding, "it's a matter of internal demand and capital controls/restricted access."

On Monday, the Russian central bank raised borrowing costs from 9.5% to 20% and introduced some capital controls to arrest ruble's slide brought by the West's punitive sanctions on Moscow. Per Wall Street Journal, the Kremlin issued a decree, stating that foreign-exchange payments under loan agreements to non-resident Russians would be prohibited from March 1.

"Capital controls without demand don't make an impact on price. Capital controls mean price will deviate to one side or the other depending or where the demand is," Kruger said while explaining the source of Russian premium.

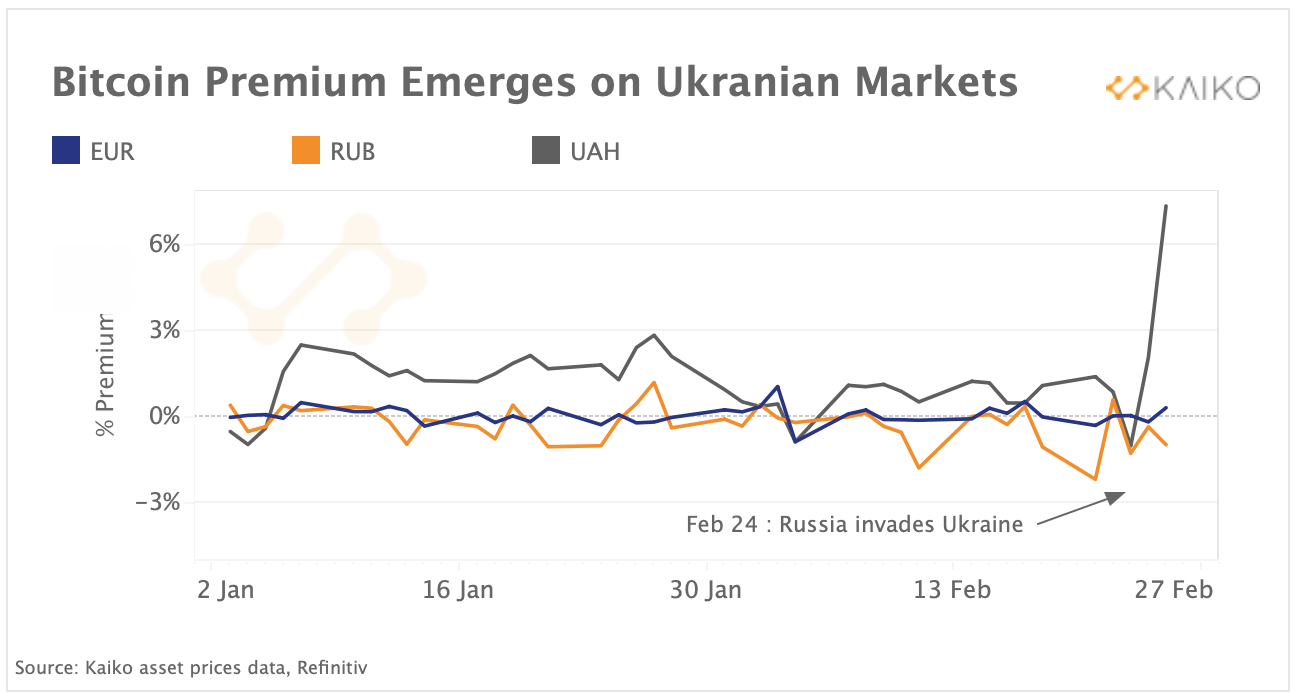

Data tracked by Kaiko, a Paris-based cryptocurrency research provider, show bitcoin traded at a 6% premium on dominant digital assets exchange Binance's Ukrainian hryvnia (UAH) market compared to bitcoin's price in the U.S. dollar market following Russia's invasion of Ukraine. The premium perhaps stemmed from Ukrainians looking for alternatives amid disruptions in foreign exchange markets.

"Demand surged on Binance as local Ukrainian currency markets faced significant disruptions, with the Ukrainian central bank temporarily halting foreign currency withdrawals and the Ukrainian hryvnia falling to all time lows versus the U.S. Dollar," Kaiko's research analysts Clara Medalie and Dessislava Aubert said in a weekly newsletter published Monday.

It remains to be seen if increased demand from Ukraine and Russia is the beginning of wider adoption of the cryptocurrency as a safe haven or a one-off event.

According to ARK36's Morch, "the biggest crypto asset is now looking at a potential decoupling from risk assets and it is doing so at a time of unprecedented uncertainty."

"Cash used to be king in times of crisis but now rising inflation levels and broader macroeconomic woes make holding large amounts of cash risk in and of itself," Morch added.  Bitcoin trades at premium on Binance's Ukrainian hryvnia (UAH) market (Chart by Kaiko)

Consensus 2022, the must-attend crypto and blockchain experience of the year, is heading to Austin, Texas, from June 9-12. This is the only festival showcasing and celebrating all sides of the blockchain and crypto ecosystems and their wide-reaching effect on commerce, culture and communities. Register now for the lowest price.

ICYMI In case you missed it, here are the most recent episodes of "First Mover" on CoinDesk TV:

"First Mover" has the latest as the Russia-Ukraine crisis tests the role of cryptocurrencies in war and sanctions. Christine Lee and Lawrence Lewitinn sit down with experts to examine various ways cryptocurrencies are being used, and the implications. Guests are Liat Shetret of Solidus Labs, a market surveillance and risk monitoring hub, Alona Shevchenko UkraineDAO Founder, and Kapil Rathi, CrossTower Co-Founder and CEO.

Disclaimer: The information presented in this message is intended as a news item that provides a brief summary of various events and developments that affect, or that might in the future affect, the value of one or more of the cryptocurrencies described above. The information contained in this message, and any information liked through the items contained herein, is not intended to provide sufficient information to form the basis for an investment decision. The information presented herein is accurate only as of its date, and it was not prepared by a research analyst or other investment professional. You should seek additional information regarding the merits and risks of investing in any cryptocurrency before deciding to purchase or sell any such instruments.

First Mover A newsletter from CoinDesk Were you forwarded this newsletter? Sign up here. Copyright © 2021 CoinDesk, All rights reserved. 250 Park Avenue South New York, NY 10003, USA |

Langganan:

Posting Komentar (Atom)

EmoticonEmoticon