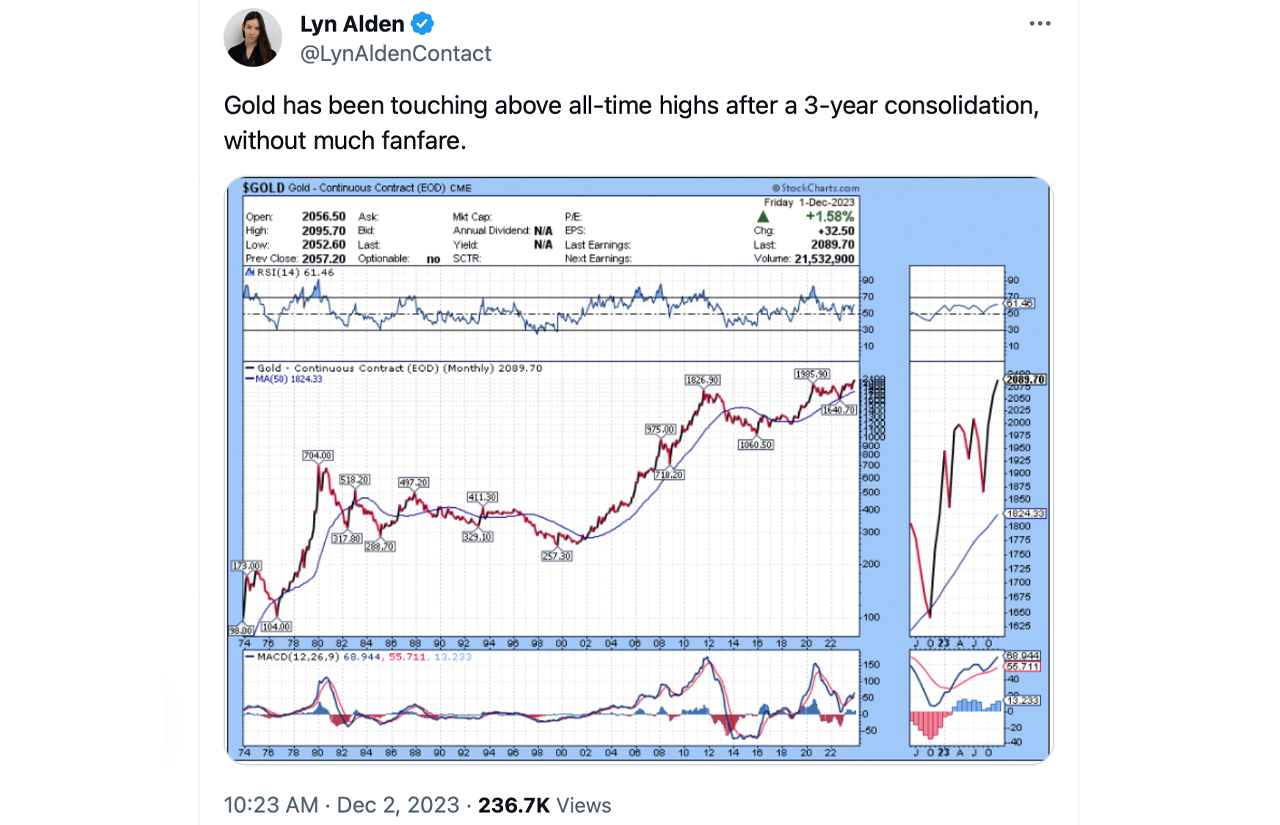

The price of an ounce of pure gold has approached its highest historical level this weekend, reaching $2,071 per ounce. This peak nearly matches its record three years ago on August 7, 2020, when during the Covid-19 pandemic, spot gold prices soared to an unprecedented high of $2,072.50 per ounce.

Gold Flirts With Lifetime Price High Amid Economic Unrest

Amid U.S. equities ending Friday on a positive note and a surge in the crypto economy’s value, the cost of a single ounce of gold is on the verge of surpassing its historical peak. Currently, gold is trading at $2,071.88 per ounce, just a fractional 0.029% below its all-time high set on August 7, 2020.

During the height of the Covid-pandemic’s uncertainty and ensuing lockdowns in 2020, concerns about the economy’s future mounted. On August 7 of that year, gold reached its intraday zenith, hitting $2,072.50 per ounce.

Today, as the global economy grapples with ongoing uncertainty, gold prices are mirroring these concerns, drawing investors to this traditional safe-haven asset. While the intensity of the Covid-19 crisis has diminished, China is now grappling with a surge in mysterious respiratory diseases, including mycoplasma pneumonia.

This alarming increase in cases has led the World Health Organization (WHO) to request more details about the outbreak. Moreover, the ongoing international tensions, including the conflicts between Russia and Ukraine and between Israel and Hamas, have heightened global economic uncertainty, further enhancing the appeal of gold as a valuable asset.

Furthermore, in the U.S., the Federal Reserve’s strategy of increasing interest rates to tackle inflation has resulted in higher interest rates and market volatility, thereby heightening fears of a recession. Moreover, yield curve metrics, particularly the comparison between the 10-year and 3-month Treasury rates, a traditionally accurate forecaster of recessions, suggest a substantial likelihood of a recession occurring within the next year.

A combination of unpredictable events, geopolitical unrest, and global economic slowdowns have propelled gold prices to their current levels. This surge is also supported by significant demand for gold from central banks globally. While gold has seen a 1.73% increase in the last 24 hours, silver has not reached its historical peak and has only experienced a modest 0.65% rise during the same period.

Presently, silver’s price is markedly lower than its April 25, 2011, high of $49 per ounce. To surpass its previous peak, silver would need to witness a 92% increase. Technical analyst Gary Wagner opines that the “rally in gold and silver is far from over.” Wagner acknowledges that the present economic conditions will favor both metals, but he predicts that “it is gold that will continue to gain value at a much greater pace than silver.”

What do you think about gold’s price rise? Share your thoughts and opinions about this subject in the comments section below.

source https://news.bitcoin.com/gold-nears-record-high-amid-global-uncertainty-surges-to-2071-an-ounce/

EmoticonEmoticon