One of the backbones of crypto market in today’s world are decentralized exchanges that took the world by the storm in recent years. And as the crypto exchange market is moving and developing rapidly, it is absolutely no surprise that the exchanges have to evolve in accordance.

Therefore, today, The CEO of Soldex.ai, John Robertson will present you with the next step in crypto exchanges, which is the AI powered trading that may be the future of the token trading.

The impact of Soldex.ai and what makes it to stand out from the other projects

One of the most salient blockchain in the recent times is Solana. It took the world by storm while offering many benefits, hence it has been chosen for the Soldex.ai. Soldex.ai was created to solve certain issues caused by order-matching centralized exchanges and the trust-less custody found in the exchanges of the today. Soldex.ai will power the new avalanche of flexible financial markets. The protocols will serve as a foundational layer for such things as liquidity, custody, market making and the settlement. As mentioned previously Solana has some benefits compared to other DEXs such as Ethereum. Those would be an extremely fast transaction speed, which can hit up to 50,000 transactions per second and as if that would not be enough, the gas fees are only $0.00025 per transaction. For comparison, Ethereum can only squeeze 30 transactions per second and boasts menacing transaction fees of $12.

Since the AI is overtaking more and more of the industries around the world it is no surprise that Crypto Exchanges will not be left behind. The initial driving force behind the Solana DEX will be the implementation of the AI trading bots, which will create trading strategies and will work relentlessly 24/7. Later, the traders will be able to create their own bot trading strategies and lend them to others for the commission fee. Consequently this will incentivize community for the further development of Soldex.ai through voting rights.

One of the main reasons for the demand for automated trading is the fact that 80% of traders loose due to the blunders they make. Therefore, Soldex thought that the DEX will give people the ability to choose the trading strategy that fits them best. Different bots are being developed according to the criteria such as: margins; trading risks; 90 day success rate; trading pairs. It will also include the different criteria in the future.

As previously mentioned, the exchange is being built on Solana. The team is hoping that it will attract the new users due to the rapidness of the trades and the technical potential in the future. Also one thing that new traders usually find annoying is the entire debacle that they have to go trough while opening new accounts. Soldex fully recognized this and have managed to make Soldex.ai completely permission-less, that is to say no KYC and ID checking, so you could jump into trading, providing liquidity and staking in absolutely no time.

Solana will have its own toke SOLX. Soldex is hoping that the token will help to fulfill the mission, which is to have a transparent revenue system, which would be fair and profitable.

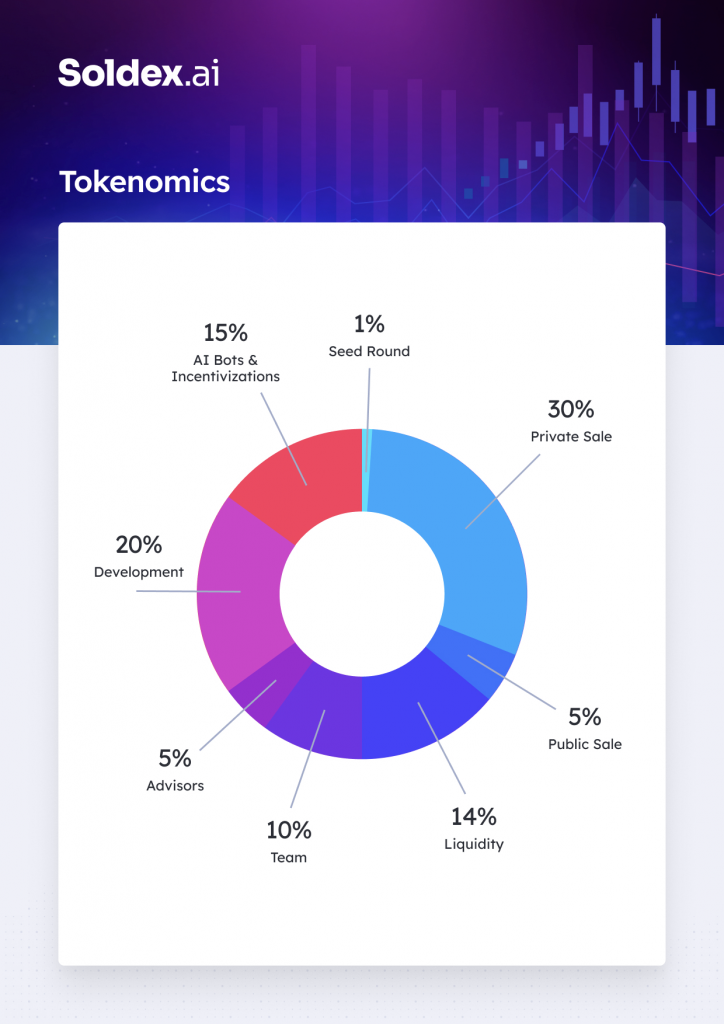

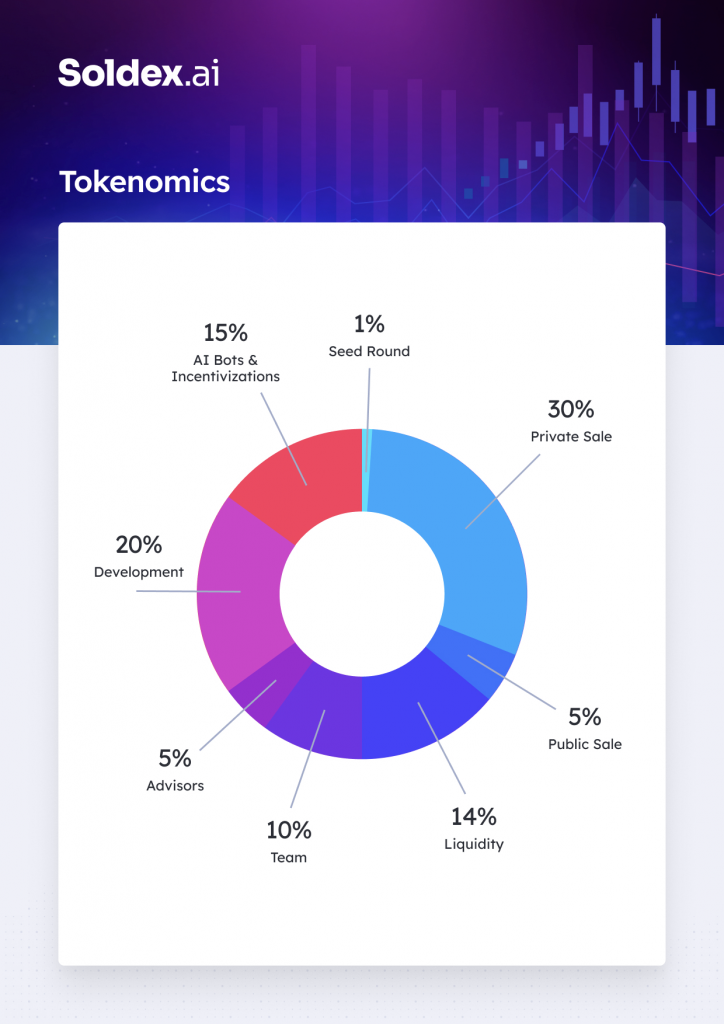

The 30% of the tokens will go through the private sale, they make the majority. Around 5% will be released for the public sale. 14% will be allocated for the liquidity and the rest will be for the developers, advisors and others.

The token itself will be used for protocol governance, transaction fees and staking for profits. But in the long term the team is planning to make a bunch of improvements as Solana blockchain offers a great opportunity for technical growth in the future.

Besides the ability to make a profit on Soldex.ai, people will also have access to Soldex AI Academy. The team is hoping that it will help to build a strong community and help users to become more familiar with Solana and DeFi. Other purposes are that it will help new developers to start building, expose people to the technology offered by Solana and overall to unite the community.

As of today Soldex have seen a great interest in the SOLX token. They are on round II of sales since the round I was oversubscribed. The current price for the token is $0.06 however, on the launch on December 10 it will be $0.1. “We are happy to see high participation of the private investors, funds and many more,” CEO John Robertson Explains.

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

source

https://news.bitcoin.com/solana-based-dex-soldex-ai-ceo-john-robertson-explains-the-impact/