A NOTE FROM BOB

Big inflows for the first half. U.S. equities have a net gain of $219.2 billion and just more than $3.8 trillion in assets under management. Overall ETF assets under management are north of $6.5 trillion.

Vanguard is killing it. In case you're keeping score, Vanguard has four of the top five funds in terms of inflows in the first half of the year. S&P 500 (VOO), Total Stock Market (VTI), Total Bond Market (BND), and Value (VTV). iShares Core S&P 500 (IVV) also made the top five. Boring, plain-vanilla, indexed ETFs took in big money.

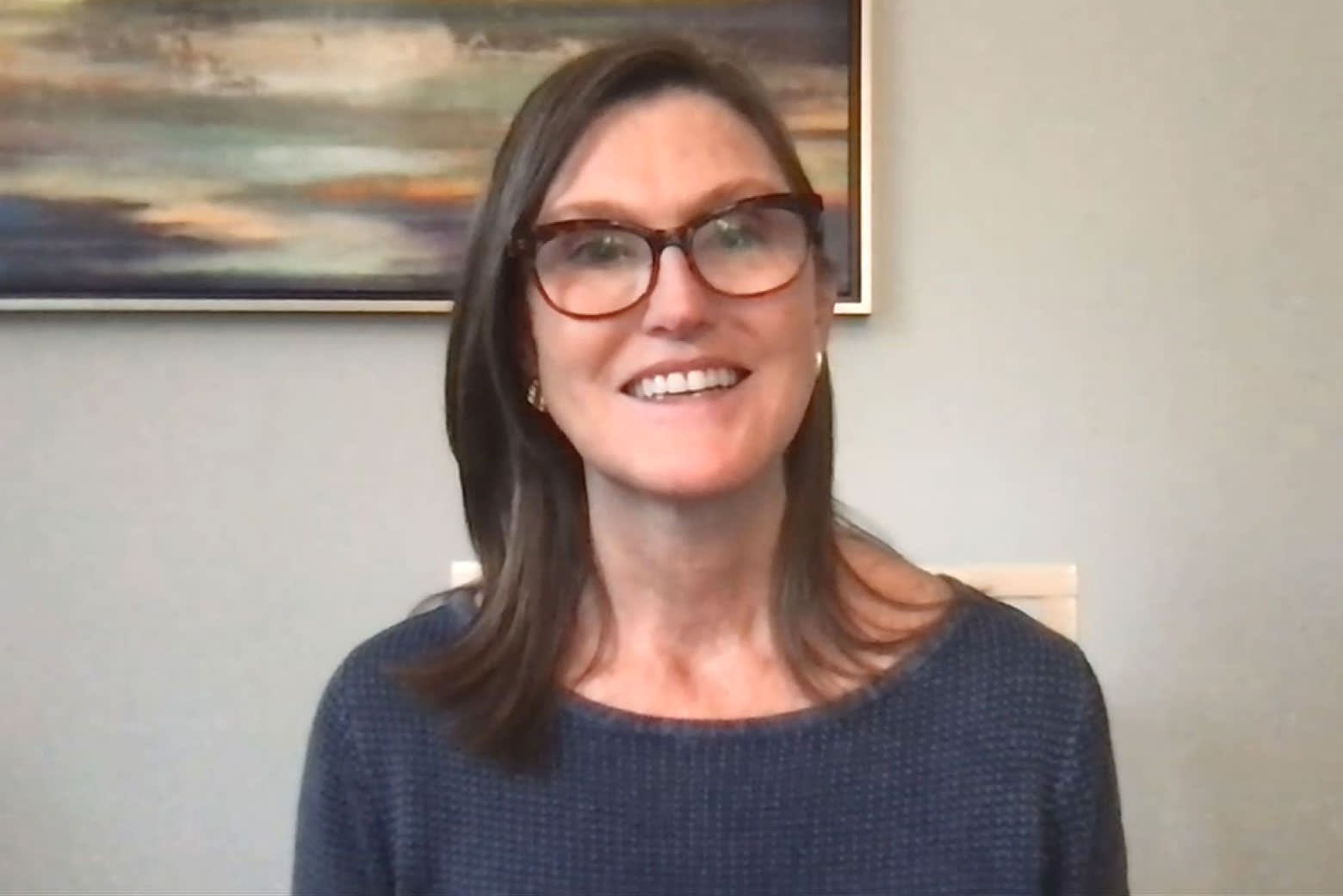

Get in line. Cathie Wood of Ark Investment has filed for a bitcoin ETF. We've lost track of how many others have filed. They punted on Van Eck's application in June, now they have until early August to decide again on that one. SEC Chair Gary Gensler is not proving to be the crypto lapdog some were hoping he would be. He wants the cover to approve a bitcoin ETF, include more regulation of bitcoin exchanges, but it's not clear if the SEC has the authority to do so. Congress may need to step in.

China ride hailing firm Didi gets the green light for index inclusion. The big indexers are falling all over themselves to include Didi. Both S&P Dow Jones' indexes and FTSE announced the China ride hailing company will be added, and smaller ETF firms like the Renaissance Capital IPO ETF (IPO) and the Kraneshares China Internet ETF (KWEB) are also likely to add Didi in the coming weeks.

For more analysis and actionable insights, catch me live on Mondays at 1 PM ET on ETF Edge. KEY STORIES

IN CASE YOU MISSED IT

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Langganan:

Posting Komentar (Atom)

EmoticonEmoticon