Up to 12 Million Iranians Own Cryptocurrency, Traders Choose Local Exchanges

Cryptocurrencies are a popular investment among Iranians and estimates suggest that the number of those who already own one coin or another may be as high as 12 million. The majority of Iranian traders prefer the services of local crypto exchanges, the chief executive of one of them claims.

Iranians Said to Transfer $180 Million in Crypto Daily

Despite the lack of proper rules for most of the crypto space and the government stance on the matter, a growing number of Iranians have been investing in decentralized digital money over the past months and years. “An estimated seven to 12 million Iranians own cryptocurrencies,” according to Hamed Mirzaei, CEO of Bitestan, one of the country’s crypto exchanges.

“Iranians’ daily crypto transactions is estimated between 30 and 50 trillion rials ($181 million), while there is no regulation over trade in cryptocurrencies,” Mirzaei was recently quoted as saying by Peyvast magazine. According to a report by the English-language business portal Financial Tribune, the executive also pointed out:

More than 88% of the deals are conducted via local exchange platforms.

This amount, Mirzaei elaborated, is higher than the total of all capital market transactions in the Islamic Republic. “An estimated seven to 12 million Iranians own cryptocurrencies,” the blockchain entrepreneur also revealed to Iranian media.

Mirzaei’s comments come after earlier this year Iranian officials voiced concerns over crypto assets attracting capital from traditional markets. In early May, digital coin trading platforms were accused of taking advantage of the volatile state of the stock market, where deals had seen a significant decline since last summer. At the time, the Central Bank of Iran (CBI) advised Iranians to avoid cryptocurrency, warning them that these investments would be at their own risk.

Later that month, the parliament’s leadership asked the National Tax Administration to profile the owners of Iranian cryptocurrency exchanges and report back. The Speaker of the Majlis, Mohammad Baqer Qalibaf, stated that imposing a ban on crypto trade is not enough and called on the CBI to develop precise regulations for the sector. In July, members of the Islamic Consultative Assembly proposed a bill aimed at adopting rules for the exchange market.

Restrictions on crypto trading would deprive Iran of opportunities, Iranian fintech companies warned this year, expressing their opposition to government attempts to curb the operations of crypto exchanges. In April, the CBI authorized domestic banks and money exchangers to use locally mined cryptocurrencies to pay for imports but authorities went after other coin trade. The startups insisted crypto trading is not illegal and called on lawmakers and regulators to adopt rules allowing the sanctioned country to continue to benefit from decentralized money transfers.

Do you think Iranian authorities will change their stance on cryptocurrency exchange and investment? Share your expectations in the comments section below.

source https://news.bitcoin.com/up-to-12-million-iranians-own-cryptocurrency-traders-choose-local-exchanges/

BIA Dinner: Alchemy Pay CEO John Tan Celebrates Milestones of 150 Key Nodes and 200K Supporters

Some of the premier figures in crypto gathered at the Waldorf Astoria, Shanghai on October 27th, 2021, to celebrate a new alliance with a mission to advance the blockchain industry. The Blockchain Infrastructure Alliance (BIA) was inaugurated with a dinner hosted by the crypto-fiat payment network, Alchemy Pay, alongside co-hosts Polygon Network, NEAR Protocol, Draper Dragon, and Bit.Store. The event was graced by the presence of over a hundred celebrities and leaders of the industry, including Tencent, Alipay, Mastercard, Binance, Huobi, OKEx, Polygon, NEAR, NEO and many others.

At the dinner, John Tan, the CEO of Alchemy Pay, gave an opening speech on behalf of Alchemy Pay and took the opportunity to present the company’s ecosystem as well as remark on the outlook for BIA.

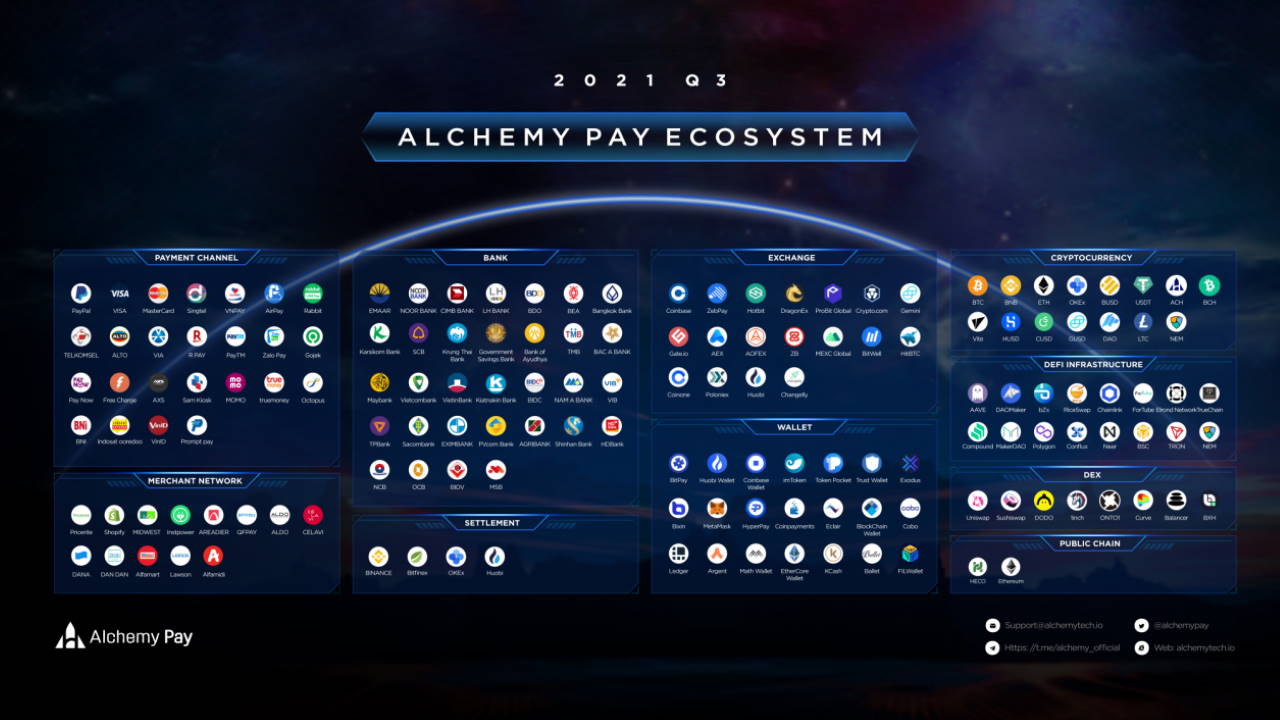

Tan showed just how much Alchemy Pay’s network had developed. After two years of rapid expansion, the Alchemy Pay ecosystem now boasts more than 150 core nodes, including banks, merchant networks, DeFi protocols, exchanges, remittance partners, and others.

Alchemy Pay’s business scope currently covers more than 200 payment channels in over than 60 countries and regions around the world.

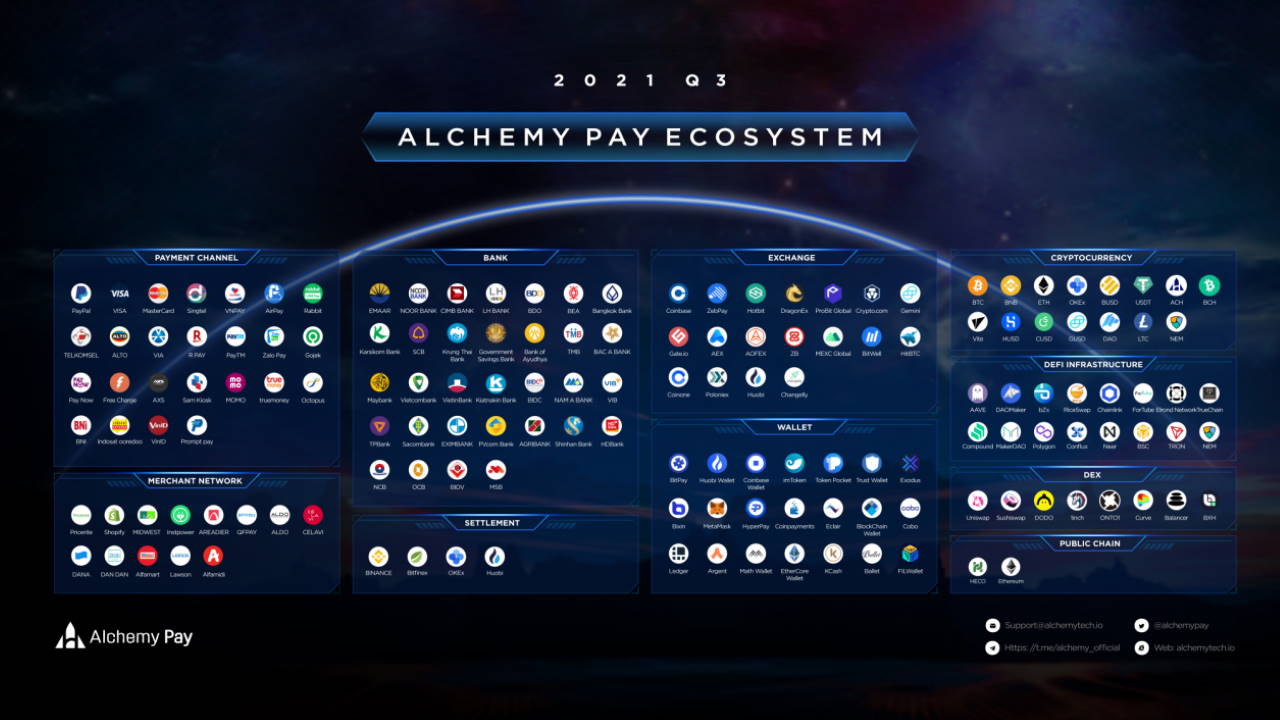

During the third quarter of last year, Alchemy Pay’s utility token, ACH, was listed on Huobi, and in the third quarter of this year, ACH was launched on Coinbase, one of the global largest cryptocurrency exchange – anchoring ACH firmly in the global crypto economy.

ACH has also been listed on world-renowned exchanges such as POLONIEX, Gate.io, Changelly, and Uniswap. Its value has risen as much as 150-fold on the back of rising community supporters and investors to over 200,000.

Alchemy Pay’s ACH and services can be used in many areas of everyday life, such as in-store shopping, hotel accommodation, and groceries. However, other blockchain transactions such as cryptocurrency and DeFi investments are also possible.

Alchemy Pay is deeply linked to both cryptocurrency and the traditional fiat currency world. As veterans in both of these areas, Alchemy Pay can provide users with convenient and reliable access to crypto payments. Alchemy Pay provides millions of merchant enterprises with a bridge between crypto and fiat economies.

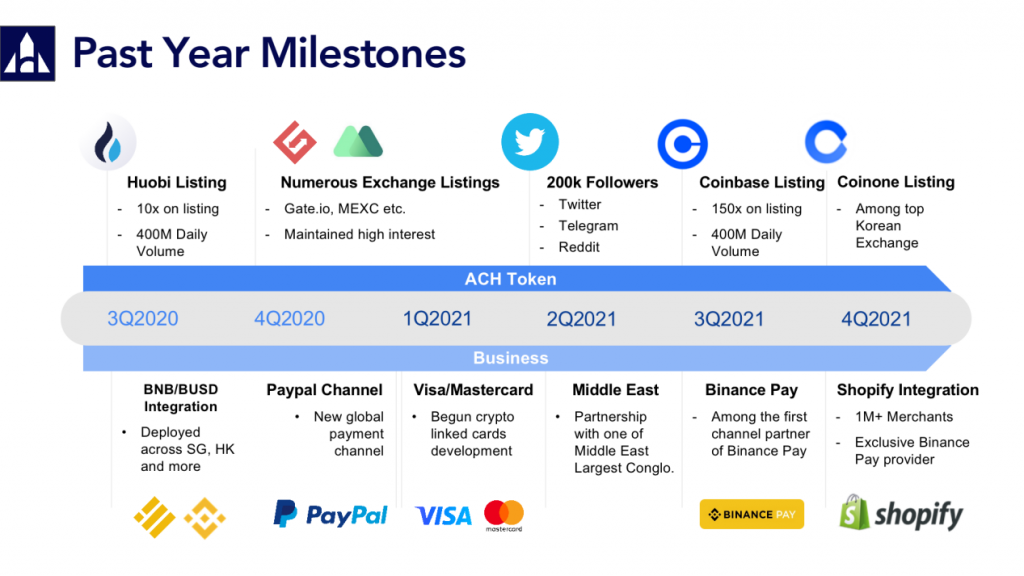

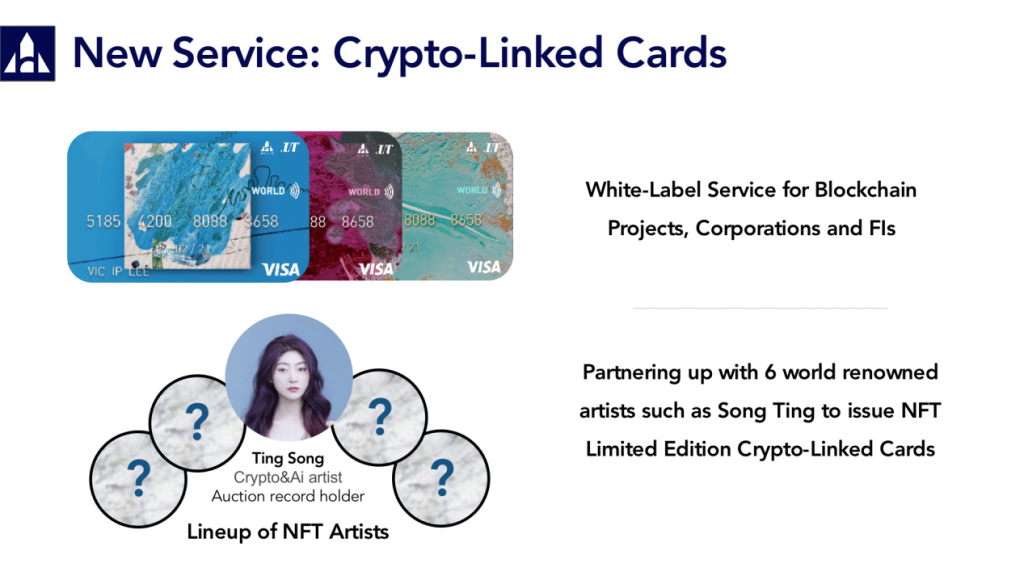

An exciting development of Alchemy Pay’s virtual crypto-linked card project was also announced at the event. Alchemy Pay will be collaborating with six well-known NFT artists from various countries around the world to launch a total of 36 virtual crypto-linked card designs. These works of art are limited edition NFTs co-branded with crypto-linked virtual Visa cards that offer ultra-premium benefits such as 24-hour butler service, global airport first-class lounges, and hotel perquisites.

One of the six artists who created the card artworks in collaboration with Alchemy Pay, Song Ting, a “Forbes 30 under 30” star who currently holds the record in NFT sales in the Chinese market, introduced herself with characteristic creative spirit at the event, proclaiming “crypto art will herald a massive thought revolution.”

Alchemy Pay’s achievements were affirmed at the event by many partners. Two representatives, who are key institutional partners of Alchemy Pay, Amos Zhang, Global Market CMO and Head of Asia Pacific at NEAR, and Charlie Hu, Head of Polygon Asia, said they are very optimistic about the prospect of promoting the development of the industry together with Alchemy Pay.

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

source https://news.bitcoin.com/bia-dinner-alchemy-pay-ceo-john-tan-celebrates-milestones-of-150-key-nodes-and-200k-community-supporters/

Industrial Bitcoin mining breathes new life into tiny Texan town

Major Bitcoin miners have set up shop in a former aluminium smelting plant in the small Texan town of Rockdale.

source https://cointelegraph.com/news/industrial-bitcoin-mining-breathes-new-life-into-tiny-texan-town

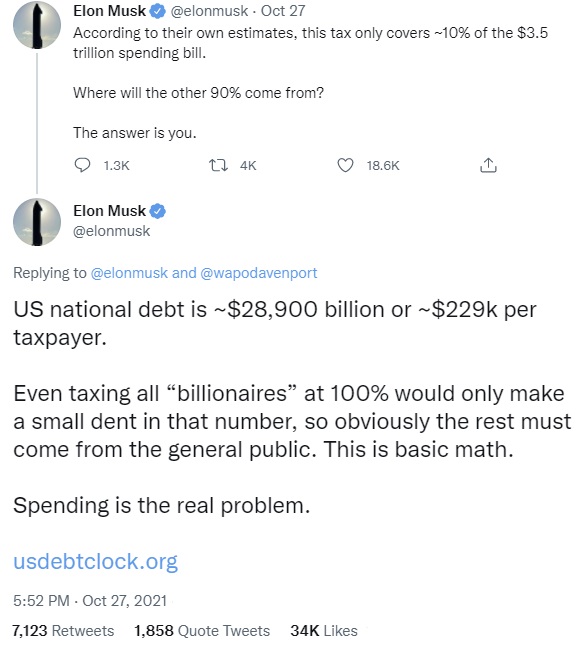

Elon Musk’s Warning About Government Spending and Unrealized Gains Tax Proposal Highlights Benefits of Bitcoin

A warning by Tesla and Spacex CEO Elon Musk about the mounting national debt in the U.S., government spending, and the proposal to tax unrealized capital gains has highlighted the benefits of cryptocurrencies, particularly bitcoin.

Elon Musk Says ‘Spending Is the Real Problem’

Tesla CEO Elon Musk made several tweets about the U.S. national debt and government spending last week. He also warned against the proposal to tax unrealized capital gains, aimed at billionaires, which was scuttled Friday amid questions about whether it would even be constitutional.

Musk believes that if the proposal were to go ahead, the government would not stop at billionaires. “Eventually, they run out of other people’s money and then they come for you,” he tweeted early last week.

Commenting on a Washington Post article stating that he would “pay as much as $50 billion under the tax over its first five years, while Bezos could pay as much as $44 billion,” the Tesla CEO tweeted to his 61.7 million followers: “According to their own estimates, this tax only covers ~10% of the $3.5 trillion spending bill. Where will the other 90% come from? The answer is you.”

The Tesla boss proceeded to explain that the U.S. national debt is currently about $28.9 trillion or $229K per taxpayer, asserting that even if all billionaires are taxed at 100%, it would only make a small dent in the debt number. “The rest must come from the general public,” he stressed. “This is basic math.” Musk elaborated:

Spending is the real problem … U.S. federal debt/GDP was 56% in 2000, now it is 126% & climbing fast.

Musk’s comments have drawn much attention. At the time of writing, his tweet has been liked 34K times and retweeted 7,123 times.

Some people strongly disagree with Musk, accusing the Tesla billionaire of not understanding economics and avoiding paying taxes. “Has anyone explained money creation to Elon?” one person tweeted.

Several pointed out that his companies are heavily subsidized by the government. One person wrote: “How do you think you became the richest man in the world? Could’ve been the $5 billion the US government gave you to start your companies?” Another said, “Spacex and Tesla only exist because of government spending.”

A third person acknowledged that “Taxation is theft,” but told Musk: “You’re a hypocrite … Pay back the billions in government subsidies you received first and then you will be able to argue against taxation.”

‘Bitcoin Has Become so Valuable’

Meanwhile, many people agreed with Musk on the government spending problem and mounting national debt, stating that this is why they put their money in crypto. Marcelo Claure, CEO of Softbank Group International, simply replied, “Totally agree.”

Lawyer John Deaton described: “The politicians’ intent is so transparent. Classic divide & conquer strategy by employing class warfare. It’s only against the billionaires – Until it isn’t. Do the math.”

Coinbase CEO Brian Armstrong agreed with Musk, stating: “Exactly — it’s gotten completely out of hand. If they are going to keep printing to service the debt and cover the deficit, then this will accelerate the move into crypto.”

The mayor of the city of Miami, Francis Suarez, who has been trying to build his city into a bitcoin hub, chimed in:

It’s why bitcoin has become so valuable. An unmanipulatable currency/store of value.

On Sunday, Musk said that he would sell his Tesla shares if it would solve the world hunger problem. Responding to a comment by the director of the United Nations’ World Food Program (WFP) that 2% of his wealth could solve world hunger, Musk wrote: “If WFP can describe on this Twitter thread exactly how $6B will solve world hunger, I will sell Tesla stock right now and do it.” However, he emphasized: “But it must be open source accounting, so the public sees precisely how the money is spent.”

What do you think about Elon Musk’s comments? Let us know in the comments section below.

source https://news.bitcoin.com/elon-musks-warning-us-debt-unrealized-gains-tax-proposal-highlights-benefits-of-bitcoin/

Rich Dad Poor Dad’s Robert Kiyosaki Warns US Sliding Into Depression After Giant Crash, Recommends Bitcoin

Robert Kiyosaki, the best-selling author of Rich Dad Poor Dad, has warned that the U.S. is “sliding into depression.” He said that a giant crash is coming, after which “a new depression” will follow. Bitcoin is among his recommendations for smart investing.

Robert Kiyosaki Sees Giant Crash Coming, Followed by a New Depression

Famous author and investor Robert Kiyosaki has warned of a new depression in the U.S. following a “giant crash.” Rich Dad Poor Dad is a 1997 book co-authored by Kiyosaki and Sharon Lechter. It has been on the New York Times Best Seller List for over six years. More than 32 million copies of the book have been sold in over 51 languages across more than 109 countries.

The famous author tweeted Friday that the U.S. is “sliding into depression.” He said President Joe Biden and the Fed are “ripping off people,” noting that they “need inflation to prevent new depression.” Kiyosaki stressed: “Inflation rips off the poor. Inflation makes [the] rich richer. Biden and Fed corrupt.” He continued:

Prepare: Giant crash then new depression. Be smart: Buy, gold, silver, bitcoin.

A number of people have voiced similar concerns about inflation. Senator Rick Scott (R-Fla) said on Fox News Sunday that Americans should be furious with the way Democrats are handling their money, adding that President Joe Biden’s Build Back Better agenda will only worsen the country’s “ridiculous” inflation.

“If you look at what they’re talking about with this — name whatever the bill is — all it’s going to do is cause more inflation … Look at what it’s doing to poor families in this country, with gas prices up 55%. Go to the grocery store, food prices are up. It’s all caused by government spending,” he opined.

This is not the first time Kiyosaki has warned that a major crash is coming. In September, he said: “Giant stock market crash coming October. Why? Treasury and Fed short of T-bills.” He noted at the time that “Gold, silver, bitcoin may crash too,” adding that cash is “best for picking up bargains after [the] crash.” The famous author emphasized that he is not selling gold, silver or bitcoin.

Kiyosaki has been recommending BTC to investors for quite some time. Earlier this month, he said: “I love bitcoin because I do not trust Fed, Treasury, or Wall Street.”

When the price of BTC rose above $60K, Kiyosaki tweeted: “Future very bright. Celebrate yet be cautious. I am waiting for a pullback before investing more.” In August, he said bitcoin was the investment with “the greatest upside.”

What do you think about Robert Kiyosaki’s warning? Let us know in the comments section below.

source https://news.bitcoin.com/rich-dad-poor-dads-robert-kiyosaki-warns-us-sliding-into-depression-after-giant-crash-recommends-bitcoin/

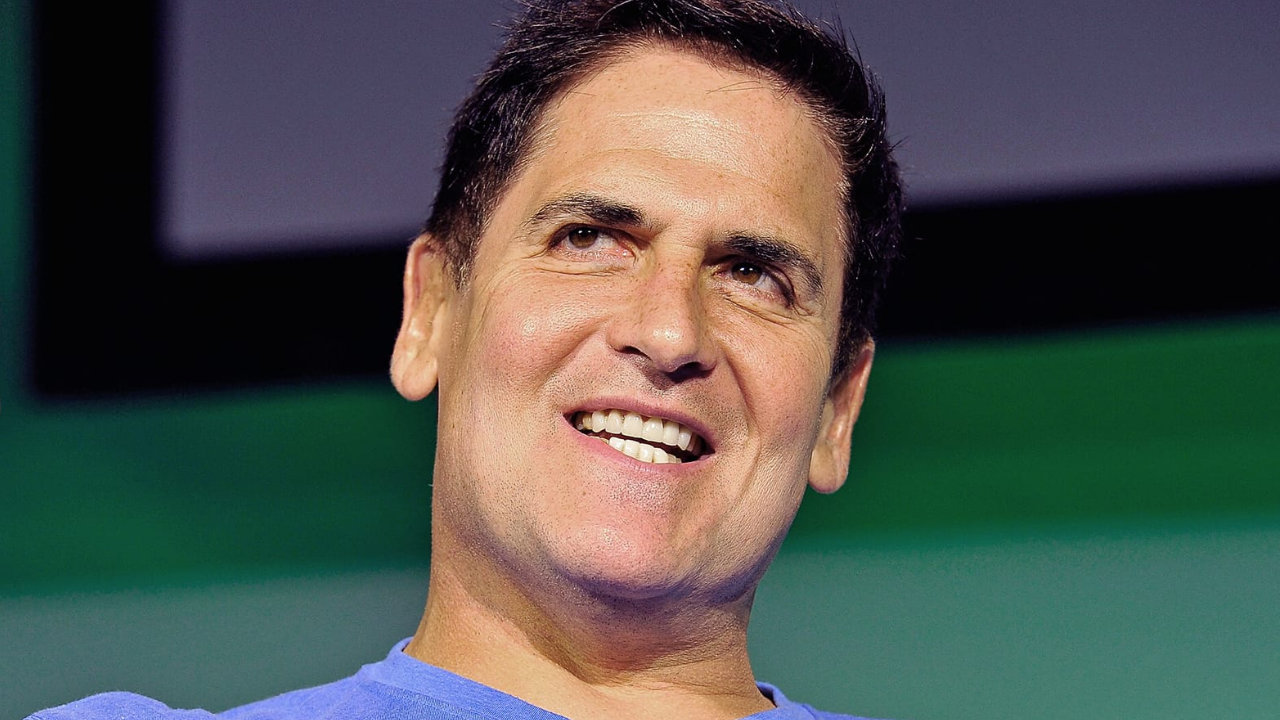

Mark Cuban and Voyager CEO Advise How to Get Into Crypto, Offer Tips for New Investors

Shark Tank star and the owner of the NBA team Dallas Mavericks, Mark Cuban, and the CEO of crypto trading platform Voyager have given some advice to people thinking of starting to invest in cryptocurrencies. “You don’t have to spend a lot of money in order to learn. It’s not like the stock market where it’s almost impossible,” Cuban said.

How to Get Into Crypto, What Investors Should Know

The owner of the NBA team Dallas Mavericks, Mark Cuban, and the CEO of crypto platform Voyager, Steve Ehrlich, gave some advice on how to get into cryptocurrency last week during the partnership announcement between the Dallas Mavericks and Voyager.

They were asked whether it was too late to get into cryptocurrency and what new crypto investors should know. Responding to the question: “Is it too late to get into crypto?” Voyager CEO Steve Ehrlich replied:

It’s never too late and, actually, now is the right time. I still think it’s the first half of the first quarter on crypto adoption.

“About 220 million people have crypto right now and we (anticipate) a billion in four years. So that shows you where we can actually go with crypto and crypto adoption,” he elaborated.

Cuban noted:

You don’t have to spend a lot of money in order to learn. It’s not like the stock market where it’s almost impossible, except on a few platforms, to spend $10 and get started.

He further shared: “My now 12-year-old son got me in dogecoin when it was less than a penny. I was like ‘let’s do this’ because it’s a cheap way for him to learn how all of this works.”

The two were also asked if someone is getting into crypto for the first time, “what are some key things [they] need to know?”

Ehrlich advised:

Enter small and just learn a little bit. Start small and I think it’s always wise to start financial investments small and then work your way up.

He continued: “As you start learning more and understanding more, then you can start increasing from there. But I think it’s always a wise place to start.”

Cuban concurred, cautioning: “You’re spending your money, so always be careful. But the other thing, look, there’s investments. Things like shiba inu [SHIB] and dogecoin [DOGE], those aren’t investments.”

What do you think about the advice given by Mark Cuban and Voyager’s CEO? Let us know in the comments section below.

source https://news.bitcoin.com/mark-cuban-voyager-ceo-advise-how-to-get-into-crypto-tips-new-investors/

Bitcoin price descending channel and loss of momentum could turn $60K to resistance

After a slight hiccup in BTC futures premium, traders seem comfortable despite the $58,000 support retest and the risk of $60,000 turning to resistance.

source https://cointelegraph.com/news/bitcoin-price-descending-channel-and-loss-of-momentum-could-turn-60k-to-resistance

Enjinstarter Announces Successful Completion of Fundraising and Pipeline of Projects for November

PRESS RELEASE. Singapore-based Enjinstarter (EJS) has completed its Token Generation Exercise (TGE), raising a total of $500,000 via a collaborative fund raising effort over 4 launchpads namely Genesis Shards, Chainboost, Starter.xyz and Enjinstarter’s own launchpad. This followed a highly-successful, oversubscribed private sale that raised $5 Million from prominent Crypto VCs and highly influential angel investors from the Blockchain and Digital Assets industry.

According to Enjinstarter CEO, Prakash Somosundram, “Enjinstarter’s native token (EJS) presents an exciting opportunity for token holders who want to ride the massive trend of Blockchain Gaming and Metaverses. We are also honoured to have had the strong support of our investors who not just contributed financially, but also supported us through the introduction of key opinion leaders and also to quality projects to feature on our launchpad”.

“With an impeccable track record of investing within the crypto gaming sector, the X21 Digital team values the long term viability of Enjinstarter in spearheading the growth and development of gaming startups in the Enjin ecosystem. We are pleased with their progress so far and look forward to the next generation of amazing blockchain games.” commented Lester Lim , cofounder of X21 Digital.

A Strong List of IDOs in the Pipeline

Right after its TGE, Enjinstarter hosted the public sale of Defina (FINA) on the 11th of October 2021. Defina an online blockchain game that combines decentralized finance (Defi), and NFT to allow players to own their gaming assets and monetize them through Play to Earn. Defina has been highly successful and has achieved more than 14 times the return on investment on its IDO price in less than a month.

Enjinstarter is currently running Gaia Everworld’s public sale which will happen from the 31st of October 2021. Gaia Everworld is the immersive, multi-region fantasy world in which players build their kingdoms, explore the lands, collect, breed and battle their Gaia Legionnaires. Gaia Everworld is part of the new generation of gaming being built on the blockchain which gives players full ownership of their characters, and rewards them for playing in a “play to earn” model of gaming which has taken the crypto space by storm in 2021.

Enjinstarter is expected to host at least 7 projects in November including Pixelverse , Scotty Beam, Killbox, ZomFi, Playermon, One Rare and Attackwagon.

“We will continue to strive to find the best Blockchain Gaming projects for our community, and the best value that we can give each project would be to ensure they run a smooth and successful campaign and get all the necessary support they need” commented Prakash.

“We are excited to be working with Prakash and the Enjinstarter team for our IDO. They have not been just partners but friends as well and are playing a key role in helping us realize the vision of our project and accelerate our investor readiness ” shared Guarav Gupta, Co-founder of OneRare-The First Food Metaverse Game.

Next Phase of Growth

Trading on Uniswap since 2nd of October 2021, Enjinstarter is currently trading at close to 16X ROI on the Public Price down from the all time high of 31X ROI achieved earlier in the month. Enjinstarter will also be introducing native staking on its platform soon to encourage long term investors to stake their tokens.

They are currently preparing for a centralized exchange listing in early November 2021

# # #

About EnjinStarter

EnjinStarter is a launchpad for Blockchain Games, NFTs and Metaverses.

They are focused on building an ecosystem for Enjin and Efinity.

Participate in all upcoming Initial Game Offering at www.Enjinstarter.com

Backed by Top Names & Institutional Investors

Enjinstarter boasts an impressive list of institutional investors including Enjin, Baselayer and many other global digital assets funds.. Notable angel investors and advisors include Maxim Blagov, Witek Radomski , Shashwat Gupta , Garlam Won , Gabby Dizon , Heslin Kim, Kelly Choo, Shitij Gupta, Melvin Yuan, Rakesh Gupta and Joni Kuiru.

Complete List of Institutional Investors:

Enjin, Baselayer, Momentum 6, Arkstream Capital, AU21 Capital, Aussie Capital, Angleone Capital, Avalon Wealth Club, Boost Innovation Labs, Brotherhood Ventures, Basics Capital, Chainstride Capital, Crypto Dorm Fund, CSP Dao Network, Dutch Crypto Investors, Exnetwork Capital, Follow the Seed, HG Ventures, Hello Capital, It’s Blockchain, Kangaroo Capital, Moon Whale Ventures, Oracles Investment Group, Otis Capital, Tag Ventures, Three M Capital, TK Ventures, Starter Capital, Skybridge 20 Ventures, Vendetta Capital, 6k Starter and 0x Ventures.

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

source https://news.bitcoin.com/enjinstarter-announces-successful-completion-of-fundraising-and-pipeline-of-projects-for-november/

Ether Inferno: Ethereum Network Burned Over $2.4 Billion Worth of ETH in 87 Days

87 days ago, the Ethereum network successfully implemented the London hard fork upgrade, and ever since then over 700,000 ether has been burned, or more than $2.4 billion using today’s exchange rates.

702,886 Ethereum Burned Since the London Hard Fork

Data from Dune Analytics indicates that on October 31, 2021, otherwise known as Halloween, 702,886 ethereum (ETH) has been burned. The burning of ethereum started on August 5, 2021, when the Ethereum network successfully implemented the London hard fork upgrade and EIP-1559.

At the time, the London hard fork upgrade included roughly five different changes but the most transformative were EIP-1559 and EIP-3554. While EIP-3554 changed the Ethereum network’s difficulty bomb, EIP-1559 changed Ethereum’s fee rate to a new scheme that makes the crypto asset ether deflationary.

Just recently, Ethereum implemented the Altair upgrade which helps smooth the consensus process from proof-of-work (PoW) to proof-of-stake (PoS). After Altair was implemented, ethereum (ETH) tapped an all-time high (ATH) two days ago on October 29, reaching $4,467 per ether.

The 702,886 ethereum (ETH) that has been burned to date is worth roughly $2.476 billion using exchange rates on October 31.

The biggest ETH burner today is the non-fungible token (NFT) marketplace Opensea which has burned 91,171 ether. This is followed by typical ether transactions that everyday users and organizations send which amounts to 63,441 ether burned. The decentralized exchange (dex) Uniswap V2 has burned 51,217 ether, making it the third-largest burner today.

While tether (USDT) is the fourth-largest burner on the network on Sunday, the stablecoin USDC is the eighth-largest in the pack. Other notable platforms and networks that contribute significantly to the ether burn rate include Metamask, Axie Infinity, and the dex aggregator 1inch.

Meanwhile, statistics from bitinfocharts.com indicate the average transaction fee on the ETH network is 0.012 ether or $51.16. Metrics from l2fees.info are far more modest with Ethereum network fees recorded at $10.21 per transaction. L2fees.info also shows that transferring Ethereum-based tokens can cost $23.26 per transfer and swapping a token via a smart contract can cost $51.05 per transaction.

What do you think about the 700K ether or $2.4 billion worth of ethereum burned since August 5? Let us know what you think about this subject in the comments section below.

source https://news.bitcoin.com/ether-inferno-ethereum-network-burned-over-2-4-billion-worth-of-eth-in-87-days/

Top 5 cryptocurrencies to watch this week: BTC, ETH, BNB, MATIC, FTM

Bitcoin is witnessing modest profit-booking, but the long-term trend remains intact and altcoins like ETH, BNB, MATIC and FTM may remain in focus in the short term.

source https://cointelegraph.com/news/top-5-cryptocurrencies-to-watch-this-week-btc-eth-bnb-matic-ftm

Inside the blockchain developer’s mind: What is a testnet?

By familiarizing themselves with the nuances of testnets, blockchain developers can become better equipped to evaluate specific testnet releases.

source https://cointelegraph.com/news/inside-the-blockchain-developer-s-mind-what-is-a-testnet

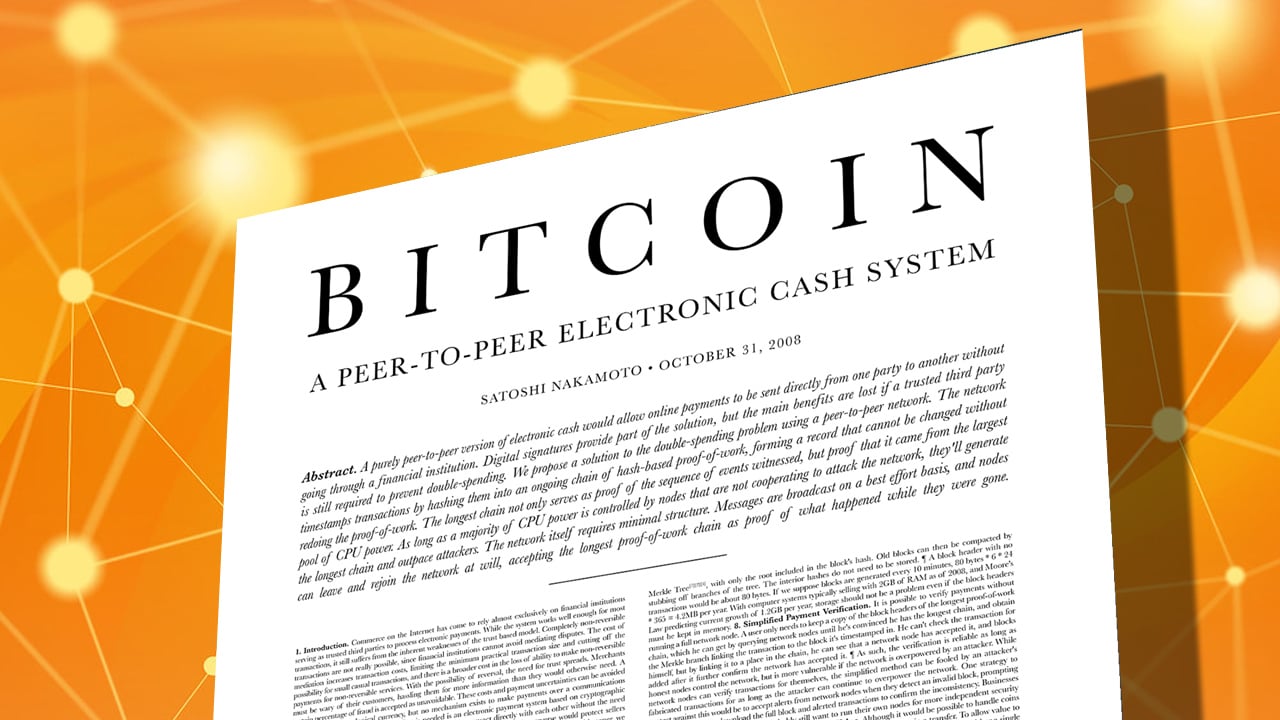

Celebrating the Seminal Bitcoin White Paper Satoshi Nakamoto Published 13 Years Ago Today

All around the world cryptocurrency supporters and proponents of blockchain technology are celebrating the 13th anniversary of the Bitcoin white paper. The summary of the inventor’s creation was published on metzdowd.com’s Cryptography Mailing List on Halloween 2008, as it gave birth to an asset with a market valuation of over $1 trillion and sparked the creation of over 10,000+ cryptocurrencies that followed Satoshi Nakamoto’s innovative design.

Introducing the Proof-of-Work Chain: A Solution to the Byzantine Generals Problem

13 years ago at approximately 2:10 p.m. (EDT), Satoshi Nakamoto published the Bitcoin white paper, a summary of the innovative network and native cryptocurrency that changed the world. The 12-part white paper starts off with an indented paragraph called an abstract which explains that Bitcoin is a “purely peer-to-peer version of electronic cash [that] would allow online payments to be sent directly from one party to another without going through a financial institution.”

When the paper was first published, academia and computer scientists worldwide were not aware that Bitcoin’s inventor solved a problem that had plagued computer scientists for years — the “Byzantine Generals Problem” or the “Byzantine Fault.” Two weeks after Nakamoto published the white paper on Halloween 2008, he told the pseudonymous member of metzdowd.com’s Cryptography Mailing List, James A. Donald, the inventor solved the problem. Nakamoto said on November 13, 2008:

The proof-of-work chain is a solution to the Byzantine generals’ problem.

The benefits of Nakamoto’s paper were clear and the advantages of triple-entry bookkeeping became apparent to people who studied the inventor’s paper and witnessed the launch of the network on January 3, 2009. Satoshi also told Donald a few days earlier, that the “proof-of-work chain is the solution to the synchronisation problem, and to knowing what the globally shared view is without having to trust anyone.”

Triple-Entry Bookkeeping: Nakamoto’s Bitcoin Invention Has Forever Changed the World

Since then, Nakamoto’s paper gave birth to the Bitcoin network and the myriad of blockchains that followed. Moreover, the white paper is leveraged in academia quite a bit these days as it is referenced in many crypto network white papers and cited 17,201 times on Google Scholar. It is safe to say there hasn’t been another white paper as prolific and innovative as Nakamoto’s since its release on October 31, 2008. It quite literally invoked the next level of ledger accounting systems as triple-entry bookkeeping — in contrast to single and double-ledger systems — offers a concept that is nearly trustless, if we remove trusting the autonomous system.

Bitcoin transactions are pseudonymous and users can add as much privacy as they want as the system offers both public transparency and privacy at its core. “The traditional banking model achieves a level of privacy by limiting access to information to the parties involved and the trusted third party,” the Bitcoin white paper details. “The necessity to announce all transactions publicly precludes this method, but privacy can still be maintained by breaking the flow of information in another place: by keeping public keys anonymous.”

Just as the printing press changed society for the better and allowed people to learn without an apprenticeship and just as the combustion engine made traveling a whole lot faster, Satoshi Nakamoto’s Bitcoin invention is one that has forever changed the world.

In the beginning skeptics, bankers, and governments mocked and laughed at the nascent technology and in time they even tried to attack crypto’s exponential growth. These days, the biggest financial institutions in the world are trying to adapt to Nakamoto’s concepts and governments are trying to produce their own versions of blockchain technology.

The white paper is now a very important paper that is hosted on the websites of large corporations, city web portals, and cited as one of “the seminal works” of computer science. On Lex Fridman’s podcast at the end of April 2020, Twitter CEO and Square co-founder, Jack Dorsey, told Fridman the white paper is like “poetry.”

“I think the Bitcoin whitepaper is one of the most seminal works of computer science in the last 20 or 30 years,” Dorsey said.

Bitcoin.com News readers that are interested in reading the innovative Bitcoin white paper can read Satoshi Nakamoto’s famous paper in its entirety here.

What do you think about the 13th anniversary of the Bitcoin white paper? Let us know what you think about this subject in the comments section below.

source https://news.bitcoin.com/celebrating-the-seminal-bitcoin-white-paper-satoshi-nakamoto-published-13-years-ago-today/

Most buzzed-about stories this week

| Powered by Platform 3 Key Media 317 Adelaide Street West, Suite 910 Toronto Ontario M5V 1P9 Canada You are receiving this email as a subscriber to or because you have at some time in the past indicated that you wished to receive news, promotions or other information from Key Media that we may feel is relevant and of interest to you. You may unsubscribe at any time merely by following this link : Unsubscribe |

What is the future of agent training?

|